By URN

Alpha MBM Investments LLC, an Emirati-based company has entered negotiations with Uganda over the possibility of investing in the refinery project in Uganda.

The company is said to be an investment arm of a prominent member of the Royal family of the United Arab Emirates, Sheikh Mohammed bin Maktoum bin Juma Al Maktoum.Sheikh Mohammed Bin Maktoum Bin Juma Al Maktoum last year visited Uganda as part of the efforts to expand his business empire.

Around the time he and his entourage were in Uganda, the project framework agreement (PFA) between the government and an American-led Albertine Graben Energy Consortium (AGRC) had come to an end and the government had decided not to renew it.

The Minister of Energy and Mineral Development, Ruth Nankabirwa confirmed that a Memorandum of Understanding (MoU) was signed on 22nd December 2023 between the Government of Uganda and Alpha MBM Investments LLC from the United Arab Emirates, outlining cooperation and negotiation terms for the Refinery Project.

She said negotiations of the key commercial agreements between the Government and Alpha MBM Investments LLC commenced on 16th January 2024 and are expected to be concluded within three months.

It is said that Expressions of Interest (EOIs) had been received from potential investors in the refinery projects which was estimated to cost about five billion dollars.

Some of those that had reportedly expressed interest in the project included Alpha MBM Investments LLC, Africa Economic Aid Limited, Bakertilly Middle East Limited, and St. Ignatius Energy.

Albertine Graben Energy Consortium (AGRC) had suggested raising some of the money to construct the refinery by listing it on the stock exchange. Nankabirwa said Alpha MBM Investments LLC has proved that it has money to move forward with the project that is behind schedule. Uganda expects commercial oil production before the end of 2025.

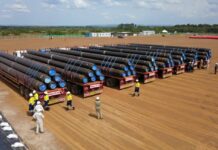

Nankabirwa said that she is praying that the new partner fast-track the process that will lead to the construction of p 60,000 barrels of oil per day (bopd) Greenfield refinery in Hoima. The Final Investment Decision (FID) by the American-led consortium should have been taken in June 2023.

Engineer Irene Bateebe, the Permanent Secretary at the Minister of Energy said the design they are taking with Alpha, they expect that at the time of signing the commercial agreements, a form of Final Investment Decision will be taken. “Because immediately we sign the agreements, we shall see some works commence. So that is an innovative way, the works commence based on the equity of the tow partners,” she said. The two partners in the project will be the private investor who will hold 60% shareholding and the Uganda National Oil Company with 40% shareholding. “And for the National Oil Company, we have already begun programming their equity contribution. They have some portion and for the next financial year 2024/2025, we equally programmed some financial contribution. So they should be able to put on table their equity” Bateebe revealed.

Alpha MBM Investments LLC becomes the third investor to take part in the refinery project in Uganda. In February 2015, the government selected a consortium led by Russia’s RT Global Resources LLC and South Korea’s SK Engineering & Construction Co. to build and operate the refinery.

The negotiation about the PFA with the Russian-led investors failed leading to a new bidding process that had the American-led AGRC selected as a preferred bidder.

The Front-End Engineering Design (FEED) for the Refinery Project was completed by (AGEC), the then Lead Investors in August 2021, and approved by the Petroleum Authority of Uganda (PAU) in July 2022Legal FrameworkThe National Oil and Gas Policy for Uganda 2008 recommends refining the discovered oil in-country to supply the national and regional petroleum product demand before consideration of exportation.The Petroleum (Refining, Conversion, Transmission and Midstream Storage) Act 2013 provides among others, the legal foundation for the development of a Refinery in Uganda, and other Midstream infrastructure like pipelines and storage facilities.